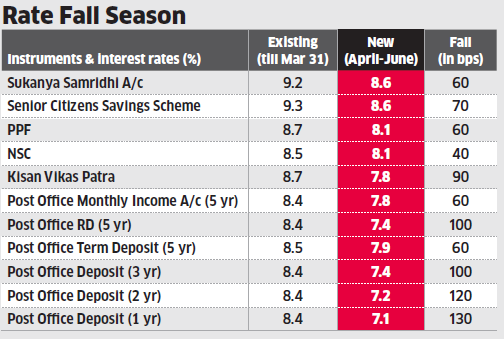

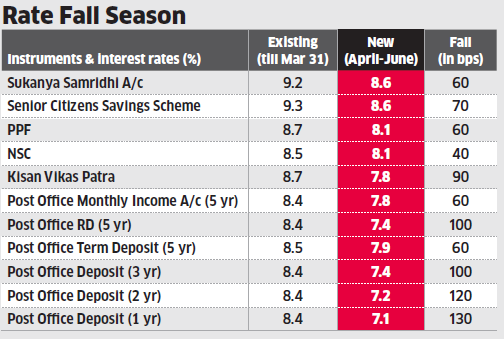

The government has notified lower interest rates for the small savings schemes (see the Rate Fall Season table for more details). Senior citizens, who depend on interest income, will be affected the most by this rate reduction.

Experts warn of more pain for small savings investors as the government is going to align interest rates on small savings products on a quarterly basis now. For example, the new rates are applicable only for April-June quarter of 2016.

"The government has not changed the interest setting formula. Only change this time is notifying rates for a quarter instead of the full financial year," says Manoj Nagpal, CEO, Outlook Asia Capital. For example, PPF will continue to earn 25 bps more than the average 10-year yield on government securities.

Why did the government go for quarterly changes now? "High small savings rate was the stumbling block why banks were not able to cut deposit and lending rates," says R Sivakumar, head -fixed income at Axis Mutual Fund.

Experts believe that the transmission will be more in the coming months. "We expect the 10-year yield falls to around 7% by December because RBI may cut 50 to 75 bps before December," said Sivakumar. And since small savings rates are linked to market rates now, it is also expected to come down further in the coming quarters.

Though this is good news for equity and long dated bond investors, it is bad news for small savings investors. So they need to align their strategies accordingly. As a first step, they need to segregate the small schemes where the interest rates are fixed for the entire tenure. "In schemes like senior citizen savings scheme, NSC, KVP, etc, the new rates are applicable only for new customers.

So Investors should rush and invest before March 31," says Amol Joshi, founder, PlanRupee Investment Services. However, there is no need to rush in to other products like PPF, where the lowered rates will be applicable for the entire accumulated corpus and not just for the new investments.

PPF rate now is already at all-time low and is expected to go down further if the government continues with the same formula in the coming quarters. For example, if the 10-year yield falls to 7% by end of December, the PPF rates for January-March quarter of 2017 will only be 7.25%.

However, there is no need for investors to avoid PPF altogether. "In addition to the government backing and tax benefits, PPF continues to offer reasonable spread above benchmark rates. So it will remain attractive despite the quarterly rate resets," says Manoj Nagpal, CEO, Outlook Asia Capital. And even if the PPF rate falls to 7.25%, it still will be higher than the prevailing inflation rates (CPI inflation was at 5.18%).

The small savings investors also need to look outside now. There will be a lot of fixed maturity plan (FMP) launches before March 31 that investors can consider. "Investing into three-year plus FMPs (ie 1,110 days) is a good option now, as the four-year indexation makes it tax efficient," says Amol Joshi of PlanRupee Investment Services.

Four-year indexation will be available because these products will be stretching into five financial years. Listed tax savings bond, where the yield is around 7.5%, is another good option the investors in high tax brackets can consider.

Experts warn of more pain for small savings investors as the government is going to align interest rates on small savings products on a quarterly basis now. For example, the new rates are applicable only for April-June quarter of 2016.

"The government has not changed the interest setting formula. Only change this time is notifying rates for a quarter instead of the full financial year," says Manoj Nagpal, CEO, Outlook Asia Capital. For example, PPF will continue to earn 25 bps more than the average 10-year yield on government securities.

Why did the government go for quarterly changes now? "High small savings rate was the stumbling block why banks were not able to cut deposit and lending rates," says R Sivakumar, head -fixed income at Axis Mutual Fund.

Experts believe that the transmission will be more in the coming months. "We expect the 10-year yield falls to around 7% by December because RBI may cut 50 to 75 bps before December," said Sivakumar. And since small savings rates are linked to market rates now, it is also expected to come down further in the coming quarters.

Though this is good news for equity and long dated bond investors, it is bad news for small savings investors. So they need to align their strategies accordingly. As a first step, they need to segregate the small schemes where the interest rates are fixed for the entire tenure. "In schemes like senior citizen savings scheme, NSC, KVP, etc, the new rates are applicable only for new customers.

So Investors should rush and invest before March 31," says Amol Joshi, founder, PlanRupee Investment Services. However, there is no need to rush in to other products like PPF, where the lowered rates will be applicable for the entire accumulated corpus and not just for the new investments.

PPF rate now is already at all-time low and is expected to go down further if the government continues with the same formula in the coming quarters. For example, if the 10-year yield falls to 7% by end of December, the PPF rates for January-March quarter of 2017 will only be 7.25%.

However, there is no need for investors to avoid PPF altogether. "In addition to the government backing and tax benefits, PPF continues to offer reasonable spread above benchmark rates. So it will remain attractive despite the quarterly rate resets," says Manoj Nagpal, CEO, Outlook Asia Capital. And even if the PPF rate falls to 7.25%, it still will be higher than the prevailing inflation rates (CPI inflation was at 5.18%).

The small savings investors also need to look outside now. There will be a lot of fixed maturity plan (FMP) launches before March 31 that investors can consider. "Investing into three-year plus FMPs (ie 1,110 days) is a good option now, as the four-year indexation makes it tax efficient," says Amol Joshi of PlanRupee Investment Services.

Four-year indexation will be available because these products will be stretching into five financial years. Listed tax savings bond, where the yield is around 7.5%, is another good option the investors in high tax brackets can consider.

Source:-The Economic Times

No comments:

Post a Comment